Congratulations to Growth Platform on winning first place at the 2022 AFI Inclusive FinTech Showcase. Selected from a wide pool of Inclusive Fintech and Regtech innovators active in AFI member countries, Growth Platform stood out amongst the 10 selected finalists for its promising digital solutions that are enhancing access to, and the usage and quality of formal financial services for low-income populations in developing countries and emerging markets.

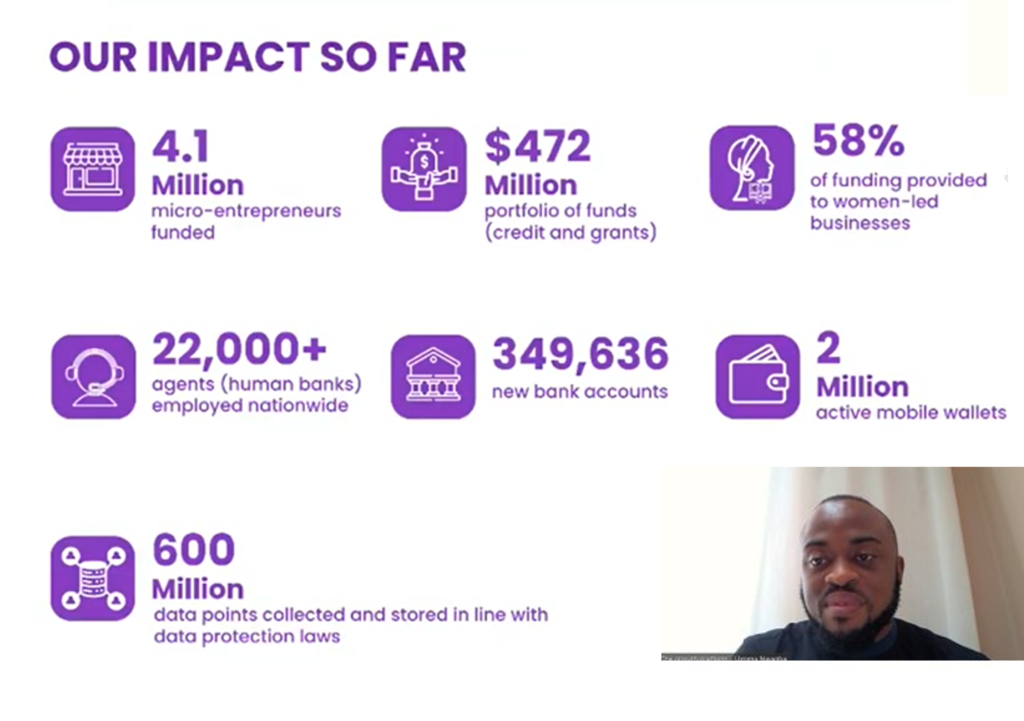

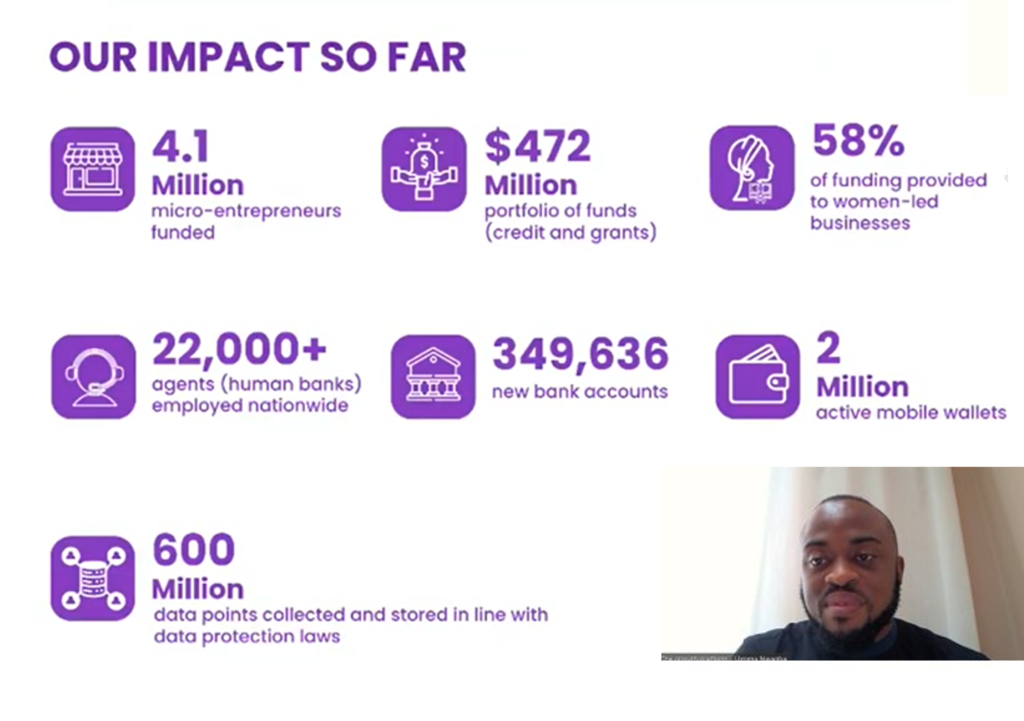

Nigeria-based Growth Platform is a technology-led and human operation to reach Micro, Small and Medium Enterprises (MSMEs) in Africa leveraging emerging technologies, agent networks and financial tools to unlock the productivity of small businesses. Over the past 5 years, Growth Platform has deployed a portfolio of $472 million across seven programs, impacting over 4.1 million microentrepreneurs and enterprises through credit, grants, or capacity building.

“[MSMEs] have been left behind because the cost to reach and serve them with traditional methods of banking and microfinance is too expensive. We have overcome this challenge through process innovation, creating a network of over 22 000 “human banks” who interact with these enterprises on the field,” said Uzoma Nwagba, Chief Executive Officer of Growth Platform, in his winning pitch to the live virtual audience and a jury comprising AFI members and invited Inclusive FinTech experts.

The Growth Platform has become a youth employment engine in Nigeria. Out of its 22,000 “human banks”, 75 percent are under the age of 35 and more than half earn university degrees. ”We have designed and built this operation that seeks to tackle the poverty challenge head on through economic empowerment of MSMEs that employs 70% of our populations, added Uzoma Nwagba.

Growth Platform also operates with an inclusive gender focus to close the gender gap in MSME financing. In fact, 58 percent of funding is provided to women-led and own MSMEs.

Watch Growth Platform’s winning pitch here!

Growth Platform, CEO Uzoma Nwagba during the live pitch at the virtual showcase

In second place came Uncap which is a funding platform seeking to revolutionize access to early-stage funding in Africa. Uncap is creating a new approach to providing innovative and unbiased funding to thousands of early-stage entrepreneurs using a remote, data-driven and largely automated investment selection process. Since its launch in 2019, Uncap has invested in 27 companies across eight sectors.

Third place went to Wizzit Digital, a mobile banking solution provider that designed solutions to cater to the needs of disadvantaged groups including women, rural populations and MSMEs — all while driving scale and sustainability. Through their certified Tap-on-Phone solution, Wizzit ensures that all merchants, sellers and service providers can accept digital payments safely, securely and cost effectively.

The winner, second and third placed finalists:

- Will be invited to participate in select activities of AFI’s Public-Private Dialogue platform

- Will receive a complementary one-year membership at the Luxembourg House of Financial Technology (LHoFT), which provides practical training, education and research services for the FinTech community.

- Will be invited to participate in the 2022 AFI Global Policy Forum (GPF) to be held in Jordan from 5-8 September 2022.

Congratulations to our top three finalists!

Below is a list of the remaining FinTech finalists (listed in alphabetical order):

Alif

Alif was founded in 2014 by Abdullo Kurbanov, Zuhursho Rahmatulloev, and Firdavs Mirzoev. Over the past seven years, it has developed into one of the leading fintech companies in Central Asia. Alif offers its clients an ecosystem of technological and financial solutions: the most widely used finance app in Tajikistan (alif mobi), the popular “buy now — pay later” payment system, the largest online retail platform (alif shop) and a cheap, fast and safe remittance system.

Emata

Emata combines next-gen tech, machine learning and a partnership model to create the future of farmer financing. Banks do not lend to farmers and farmers tend to borrow from informal moneylenders at exorbitant rates. Emata solves this $240bn problem by providing affordable digital loans. They cut costs, reduce risk and increase reach by digitizing the entire process from data collection and credit scoring to loan disbursement; and partner with cooperatives and aggregators to reach farmers at scale.

Fourthline Limited (Pollen)

Fourthline Zambia is a social and financial hive for underserved and unbanked communities in Africa. Their mission is to invest and empower underserved and unbanked communities by pioneering innovations that bring sustainable solutions to human challenges. The new product Pollen is designed to be a USSD and blockchain ecosystem for conducting cross-telecom/border remittances, payments and savings for the unbanked and underserved communities in Africa.

Gestell

Gestell is a RegTech company that makes compliance and regulatory-related activities faster, more efficient, and less costly using Artificial Intelligence; their Business Process Automation and Machine Learning solutions streamline the way Financial Institutions and Regulators obtain, store and analyze their data to better solve challenges such as money laundering, customer verification and transactions analysis.

IME Digital Solution Ltd

IME Digital Solution is a leading digital payment solution licensed by Nepal Rastra Bank Ltd., registered under IME Digital Solution Ltd., a subsidy of Nepal’s leading remittance and financial service conglomerate IME Group. It offers a wide range of payment services and a convenient way to transfer money from wallet to wallet, pay utility bills, receive domestic and international remittances directly into the wallet, and instantly process digital and QR-based payments.

Satis Fintech

Satis Fintech offers web and mobile applications using artificial intelligence, business intelligence and data science, which are gradually forming a unique ecosystem around consumer protection and the quality of financial services. Convinced that the confidence of consumers in current and future digital means is an essential ingredient for financial inclusion, it invests in national and regional platforms that connect both customers, commercial banks, MFIs and SACCOs, central banks, regulatory and supervisory authorities, observatories and other actors.

Yuva Pay

Yuva Pay is an India-based offline fintech start-up launched in 2016 that enables financial inclusion and digital footprint for the unbanked and unconnected people in India and globally through smartphones as well as Non-Smart phones through Internet or without Internet. Through the Patent-pending Technology, they are educating the last mile digitally deprived population on the advantages and benefits of the Financial Inclusion Journey And bringing them into digital footprint.

Watch all the finalists pitch their innovative solutions here!

The event is an initiative under the 2018 Sochi Accord, in which AFI’s membership committed to “create and participate in platforms for systemic dialogue and partnership among regulators and policymakers with FinTech companies and technology providers”.

Our Partners

The 2022 AFI Inclusive FinTech Showcase is supported through AFI’s Multi-Donor Financial Inclusion Policy Implementation Facility, with the participation of the French Development Agency (AFD), the German Federal Ministry of Economic Cooperation and Development (BMZ) and the Ministry of Finance of the Grand Duchy of Luxembourg.

We appreciate very much the valuable support of the Luxembourg House of Financial Technology (LHoFT) as a partner for the Inclusive FinTech Showcase.

About

About

Online

Online

Data

Data