Developing countries’ innovative approaches have been critical to the number of people without a bank account halving in just a few years – by Dr Alfred Hannig, CEO of AFI, and Dr Christoph Beier, Lecturer at the University of Bonn.

Over the past 15 years, and largely unnoticed in the West, developing countries have been making considerable efforts to advance the financial inclusion of previously disadvantaged populations. In many places, men and women have gained access to financial services, facilitated by smart regulatory measures designed to foster financial market development. Economic growth, poverty reduction, and financial market stability have been the driving goals behind these efforts.

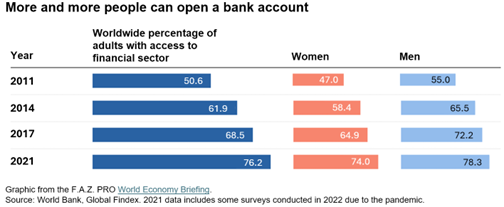

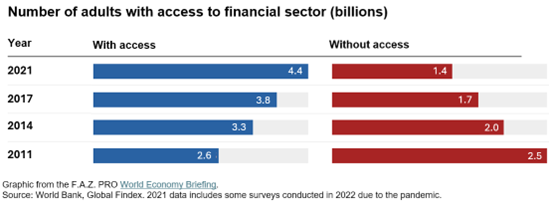

Between 2011 and 2021, the number of adults without a personal bank account decreased from 2.5 billion to 1.4 billion people, according to the World Bank’s Global Findex database: 25% of the world’s adult population remained ‘unbanked’, compared with 51% ten years previously. Notable progress has been made in women’s financial inclusion. The global “gender gap”—the difference between the amount of men and women without accounts—narrowed from 7.4% in 2017 to 4.4% in 2021.

Although figures vary significantly between countries and regions, the overall trend of progress by developing and emerging economies is remarkable.

Digitalization has been the main driver of progress

In sub-Saharan Africa, mobile phone-based, cashless transactions have significantly boosted financial inclusion. Other countries have relied on a mix of mobile phones, internet services, and payment cards to make financial services accessible to larger populations. Globally, the proportion of adults who made or received a digital payment increased by 20 percentage points between 2014 and 2021, reaching 65%. Latin America, the Caribbean, East Asia and the Pacific, and sub-Saharan Africa have all seen high increases.

Interestingly, COVID-19 triggered a major boost to financial inclusion. In many countries, financial transfers to and between poorer populations could only be processed digitally, due to strict contact restrictions. Central banks and regulatory authorities played a crucial role by easing restrictions on the use of digital financial services during this period.

It’s noteworthy that many of the technological innovations driving financial inclusion originated in developing nations, in countries which have fostered start-ups, entrepreneurs, and innovative financial products, while simultaneously creating financial policy frameworks to support them.

This calls into question the traditional paradigm of international development cooperation. While many bilateral and multilateral donors still primarily focus on North-to-South knowledge transfers, learning in the financial sector increasingly emerges from the Global South.

Collaboration on equal terms

Financial inclusion has emerged from the shadow of a niche development issue and established itself in the mainstream of economic and financial market policy. This is evident in the growing importance of the topic in advanced economies, as demonstrated by Germany’s recent financial education conference, or the newly adopted U.S. financial inclusion strategy.

In financial market regulation, global exchange between developed and developing nations now happens on an equal footing. Traditional classifications of the world into North and South, rich and poor nations, or large and small states, are outdated in the context of financial inclusion. As technology advances rapidly, all countries now learn from each other, whether in consumer protection, financial education, technology-enabled regulation and supervision, cybersecurity, or data protection.

To facilitate this exchange, new learning platforms have been created, such as the Alliance for Financial Inclusion (AFI), a network of central banks from over 80 developing countries which is increasingly funded by its members. The AFI platform enjoys strong demand and is self-managed by its members, based on their own needs.

At a time when established global governance institutions are in crisis, new forms of global collaboration are emerging which exhibit neither Western dominance nor the bureaucratic inefficiencies of organizations like the United Nations. These cooperation models operate on equal terms, embodying a principle long promoted by development organizations: developing nation ownership and governance, free from the donor-driven agendas that have traditionally shaped international development assistance.

This article was first published in German by Frankfurter Allgemeine Zeitung – LINK.