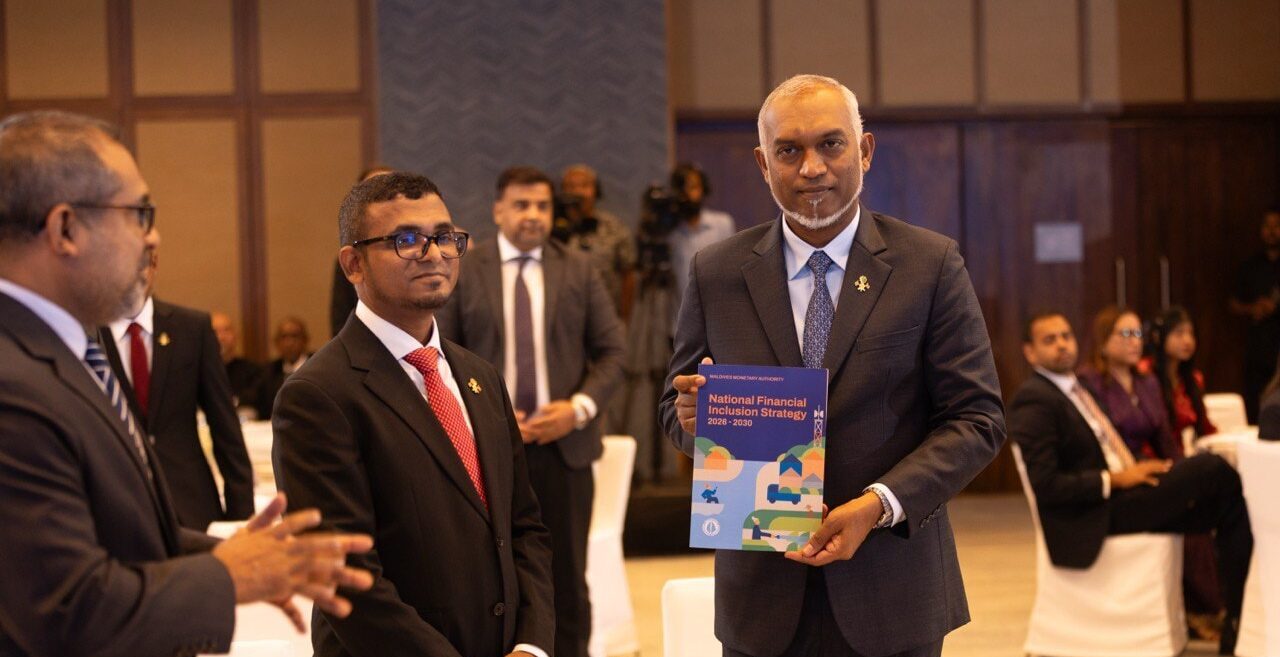

Financial inclusion strategies (FIS) are comprehensive public documents that systematically accelerate a country’s level of financial inclusion. Typically, national financial inclusion strategies (NFIS) include analysis on a country’s current financial inclusion status and constraints, measurable goals, how and when that country proposes to reach these goals, and how the progress and achievements of the NFIS will be assessed.

AFI’s Financial Inclusion Strategy Peer Learning Group (FISPLG)

Policymakers in the AFI network have reached a consensus that National Financial Inclusion Strategies (NFIS) are essential in coordinating financial inclusion policies and ensuring they are based on sound data and the impacts are robustly monitored. AFI’s Financial Inclusion Strategy (FIS) Peer Learning Group promotes the development, implementation and monitoring and evaluation of national financial inclusion strategies.

0

Member

Institutions

Institutions

0

Countries

0

Policy changes

0

Knowledge products

Chairs & Focal points

Chair

Khaled Bassiouny, Central Bank of Egypt

Co-Chair I

Caroline Waqabaca, Reserve Bank of Fiji

Co-Chair II

Amr Ahmad, Central Bank of Jordan

Gender Focal Point Lead

Nangi Massawe, Bank of Tanzania

Gender Focal Point Co-Lead

Moise Bigirimana,

National Bank of Rwanda

National Bank of Rwanda

Objectives

Member Institutions

Subgroups & Planned Activities

Maya Declarations

FISPLG & Gender

FISPLG News & Publications