The Maldives Monetary Authority (MMA) has unveiled national frameworks for financial inclusion and sustainable finance, as well as a new entity to manage payment infrastructure.

The National Financial Inclusion Strategy (NFIS), which aims to foster a financially inclusive environment, contributing to socio-economic development, is built on five key pillars: Access to Finance, Islamic Finance, Digital Finance, Inclusive Green Finance, and Consumer Empowerment & Financial Literacy.

The National Sustainable Finance Roadmap seeks to channel financing towards climate action and sustainable development priorities, encourage green, social, and sustainability-linked financial products, strengthen regulatory frameworks, and direct capital towards areas such as climate adaptation, renewable energy, sustainable housing, and resilient infrastructure.

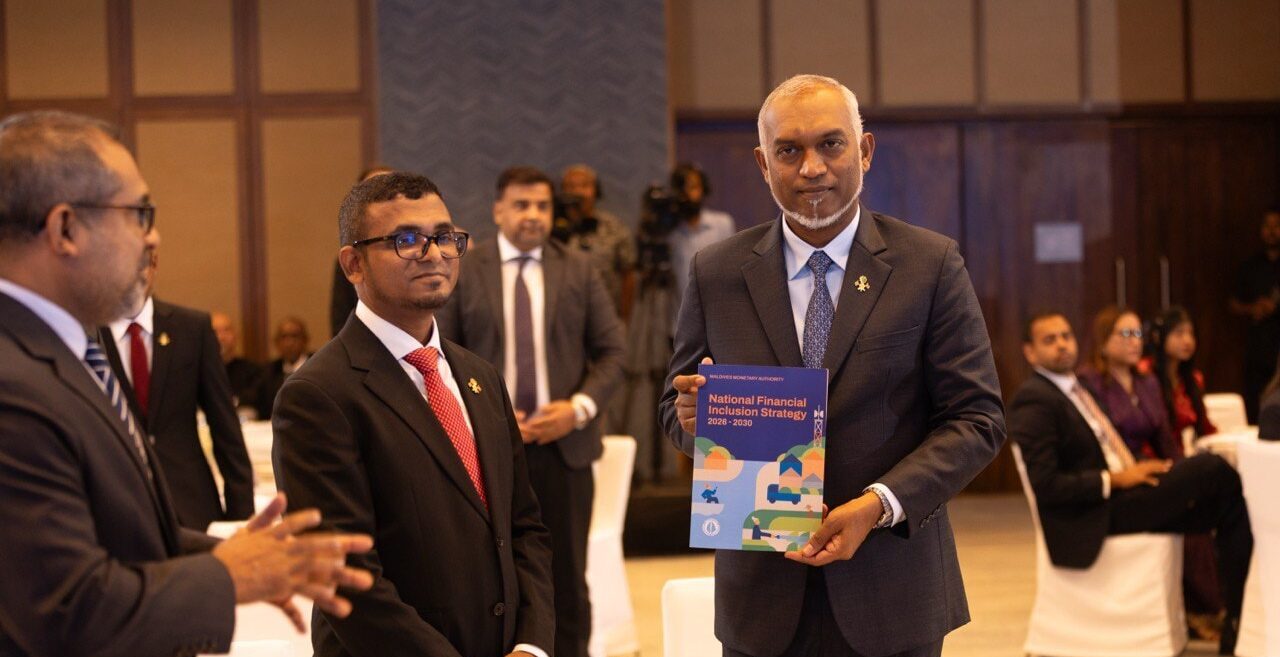

The Maldives Monetary Authority (MMA) has established Payment Maldives with the aim of establishing robust, secure, and inclusive infrastructure for digital payments. All three projects were launched on 22 December by the country’s President, Dr. Mohamed Muizzu, and the MMA Governor, Ahmed Munawar.

MMA Deputy Governor Aishath Asna Hamdi talked through the country’s financial inclusion journey, highlighting key challenges faced by different segments of society in accessing financial services. She shed light on the NFIS’s pathway to achieving financial inclusion goals, and the critical role which external stakeholders will play in its implementation.

During the ceremony, President Muizzu presented AFI’s Deputy Chief Executive Officer and Chief Operations Officer, Chee Soo Yuen, with an Appreciation Award, in recognition of AFI’s technical assistance and support in developing the National Financial Inclusion Strategy.